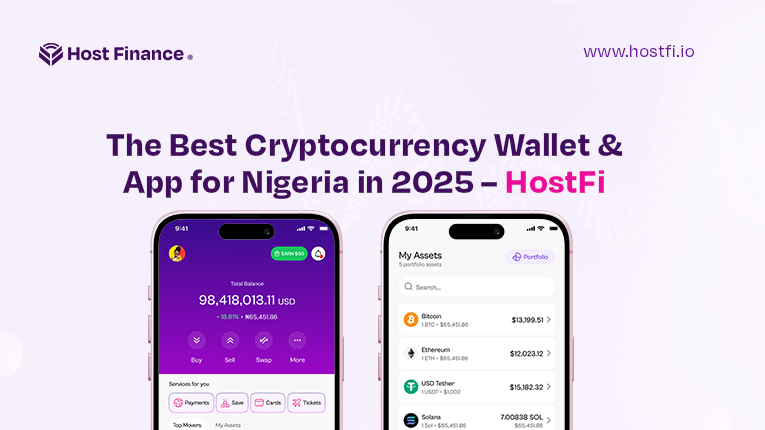

The Best Cryptocurrency Wallet & App for Nigeria in 2025 – HostFi

Nigeria’s use of cryptocurrencies continues to grow steadily, leading Africa with an estimated 35 million active wallets.

For Nigerians, digital currencies offer ways to protect savings from inflation, avoid restrictions in the banking system, send and receive money across borders, and make purchases worldwide.

When it comes to managing these assets, HostFi stands out as the best cryptocurrency wallet and app in Nigeria. It is built specifically for everyday users, freelancers, and digital entrepreneurs.

Nigerians need more than just a place to store value. They need a platform that allows them to convert, spend, and move their money instantly, securely, and without extra charges. HostFi makes this possible with real time transactions, fast naira withdrawals, USDT and USDC support, and a crypto funded Visa card — all accessible in one app.

What Is a Cryptocurrency Wallet

A cryptocurrency wallet is much more than a simple vault for digital coins, it serves as your personal command center on the blockchain.

It is the essential access point that gives you direct access to your digital assets, enabling you to manage, send, receive, and convert cryptocurrencies securely and on your own terms.

Unlike traditional wallets that hold physical cash or cards, a crypto wallet interacts with the blockchain network itself.

It stores your private keys, the cryptographic codes that prove ownership and give you control over your crypto funds.

Without these keys, you cannot access or move your assets. This makes the wallet both a powerful tool and a responsibility.

What Does a Great Cryptocurrency Wallet Do?

For everyday users, especially in a dynamic and fast-growing market like Nigeria, a cryptocurrency wallet must deliver much more than simple storage.

It must provide a seamless, intuitive, and secure experience tailored to real-life financial needs. Here are the core capabilities a top-tier wallet should have:

1. Instant Send and Receive with No Middlemen

Traditional cross-border payments, whether through banks or remittance services, are often slow, expensive, and require extensive paperwork.

A great crypto wallet eliminates these hurdles by allowing you to send and receive digital currencies instantly, directly on the blockchain, without relying on third-party intermediaries or experiencing long wait times.

This feature is essential for freelancers, businesses, and families who depend on fast, reliable transfers.

2. Smooth In-App Conversion Between Cryptocurrencies

In many wallets, converting one crypto asset to another often means transferring your funds to an external exchange, a process that can be complex, costly, and time-consuming.

The best wallets integrate seamless, real-time swaps within the app itself, enabling you to convert Bitcoin to Ethereum, or USDT to USDC, with just a few taps.

This capability offers agility and control, especially important when market conditions change rapidly or when you need to send a specific cryptocurrency for payments.

3. 24/7 Access Without Dependence on Banking Hours or Local Restrictions

Banking systems, particularly in Nigeria, often operate within limited hours and may impose restrictions that can delay access to your money.

Crypto wallets free you from these limitations by offering round-the-clock access to your funds.

At late night or during weekends, you can view your balances, execute trades, send payments, or withdraw cash instantly. This continuous availability is a game changer for managing finances flexibly.

4. Transparent, Low-Fee Global Payments

International transactions through traditional channels can be expensive and opaque, with hidden fees and unfavorable exchange rates. Cryptocurrency payments, especially those using stablecoins pegged to fiat currencies like USDC or USDT, offer clear advantages: transactions are fast, costs are minimal, and you maintain full control over your funds.

A wallet built with global payments in mind simplifies sending money anywhere in the world, whether you’re paying a supplier, supporting family, or receiving freelance earnings.

Why Nigerian Users Need The Best Cryptocurrency Wallet

The unique financial situation in Nigeria marked by frequent inflation, changing exchange rates, limited access to traditional banks, and a large community living abroad sending money home means a cryptocurrency wallet must do much more than hold funds.

Nigerian users want:

- Immediate access to funds any time of day or night

- Smooth integration with local currency, allowing quick deposits and withdrawals in Naira

- The ability to send and receive money internationally with stablecoins like USDC and USDT without high fees or long delays

- The option to switch between popular cryptocurrencies like Bitcoin, Ethereum, Solana, and stablecoins quickly and easily

- Strong security measures that avoid complicated processes or risks

- A simple and easy-to-use interface for beginners and experts alike

Why HostFi Is the Best Cryptocurrency Wallet and App Choice for Nigerians in 2025

HostFi is more than a wallet, it is a complete digital finance platform designed especially for Nigerian users. With HostFi, you get:

1. Support for Major Cryptocurrencies and Local Currency

HostFi allows you to manage Bitcoin, Ethereum, Solana, USDT, USDC, and more.

It also lets you deposit and withdraw Nigerian Naira directly without extra charges or complicated steps.

This smooth integration between local currency and digital assets gives users complete flexibility.

2. Instant and Free Conversions Inside the App

Unlike other wallets that require using exchanges to swap coins, HostFi lets you convert any supported tokens instantly within the app with no fees.

This saves time and money, especially during price changes in the market.

3. Fast and Cost-Effective International Transfers Using Stablecoins

Many Nigerians use cryptocurrencies to send money across borders. HostFi supports USDT and USDC transfers that happen in seconds, are secure, and have low costs. This provides a faster and cheaper alternative to traditional banks or peer-to-peer platforms.

4. Virtual Dollar Cards for Spending Worldwide

HostFi offers virtual Visa and MasterCard cards funded from your crypto or cash balance. These cards allow you to pay for services like Netflix, Amazon, or online courses without needing a physical bank card or extra middlemen.

5. Strong Security That Keeps You in Charge

HostFi uses a custodial model with bank-level security, two-factor authentication, PIN protection, and fraud monitoring. Users avoid complicated seed phrases but still enjoy robust protection for their funds.

6. Easy-to-Use Interface and Responsive Support

HostFi’s app is designed to be clear and simple for all users. It includes real-time balance updates, easy navigation, free internal transfers, and quick customer support available any time.

7. Reliable Access Anytime

In Nigeria, where banking hours and internet connections can be unpredictable, HostFi guarantees you can access your funds whenever you need to. Withdraw Naira, exchange tokens, or send payments without delays

The Nigerian Market and HostFi’s Role

Nigeria is ranked second worldwide for cryptocurrency use, driven by economic factors and a young population eager to use new financial technologies.

- More than 80% of adults in Nigeria use or own digital currencies in some form

- Around 35 million wallets are active in the country, showing strong demand for effective and trustworthy wallets

- HostFi stands out by providing a seamless experience that fits how Nigerians earn, save, spend, and move money today

Real-World Use Cases: Exactly Why Nigerians Love HostFi

Hedge Savings Against Inflation

With Nigeria’s inflation rate consistently fluctuating and often reaching double digits, many Nigerians are turning to cryptocurrencies as a way to protect their hard-earned money.

HostFi makes it easy to convert Nigerian Naira into stablecoins like USDC or established cryptocurrencies like Bitcoin (BTC). By holding assets in these digital currencies, users can preserve their purchasing power and shield their savings from local currency devaluation.

This is particularly important for families and individuals looking for a safer store of value amid economic uncertainty.

Freelance Payments

Nigeria’s growing freelance economy relies heavily on digital payments, especially from clients abroad. HostFi allows freelancers to receive payments directly in cryptocurrencies such as USDC or USDT.

Once funds arrive, freelancers can instantly convert these digital assets to other cryptocurrencies or Naira within the app.

Furthermore, HostFi’s crypto-backed virtual cards enable users to spend their earnings directly on global platforms like Amazon, Netflix, or Udemy without the need to convert funds first or deal with international banking restrictions.

This speeds up the payment process, reduces fees, and improves cash flow for freelancers.

Fast and Affordable Remittances

Sending money to and from Nigeria through traditional banks or remittance services often involves high fees, long processing times, and cumbersome paperwork.

HostFi changes this dynamic by enabling instant transfers using stablecoins such as USDT and USDC. Users can send money across borders securely and transparently without going through multiple intermediaries.

This feature is particularly valuable for Nigerian families who rely on support from relatives abroad or for small businesses working with international partners. HostFi’s low-cost, fast remittance option helps users save on transfer fees and receive funds quickly.

Convenient Online Shopping and Subscription Payments

With more Nigerians subscribing to international digital services and shopping online, having an easy way to pay globally is essential.

HostFi offers virtual Visa and MasterCard cards funded by crypto or Naira balances, allowing users to pay for goods and subscriptions worldwide directly from the app.

Whether it is a monthly Netflix subscription, a purchase on Amazon, or an online course payment, HostFi simplifies spending by eliminating the need for multiple currency conversions or physical cards.

This convenience opens up access to global marketplaces and services previously difficult to pay for due to banking restrictions.

What Crypto Wallet Is the Best?

Choosing the best crypto wallet depends on your needs, but in Nigeria, the ideal wallet should combine security, ease of use, support for popular cryptocurrencies, and reliable access to funds.

It should let you send, receive, and convert cryptocurrencies quickly and affordably while protecting your assets with strong security measures.

Wallets that also support local currency transactions and provide features like virtual cards for everyday spending stand out. Based on these criteria, HostFi ranks as one of the top choices because it meets all these demands while focusing on the specific challenges Nigerian users face.

What Is the Best Crypto App to Use in Nigeria?

The best crypto app for Nigeria is one that understands the local market and offers a smooth experience for Nigerians to manage digital assets alongside Naira.

It should support multiple cryptocurrencies like Bitcoin, Ethereum, USDC, and USDT and enable instant conversions inside the app without high fees or delays.

Additionally, the app should offer fast Naira withdrawals, global payment options, and strong security.

HostFi fulfills these requirements by providing a user-friendly platform built with Nigerians in mind, offering everything from instant crypto swaps to virtual Visa cards and 24/7 customer support.

Is HostFi Legit in Nigeria?

Yes, HostFi is a legitimate and trusted cryptocurrency wallet and app in Nigeria.

It operates with transparent security protocols, including bank-level encryption and two-factor authentication, ensuring users’ funds are protected.

HostFi complies with relevant regulations and works to provide reliable service tailored to Nigerian users’ needs.

It has gained positive reviews from users who appreciate its ease of use, fast transactions, and excellent customer support.

For anyone looking to safely store, convert, and spend cryptocurrencies in Nigeria, HostFi is a dependable choice.

Conclusion

As Nigeria continues to lead Africa’s digital currency movement, having the right cryptocurrency wallet and app is more important than ever.

HostFi stands out as the best cryptocurrency wallet and app in Nigeria because it combines strong security, support for multiple popular cryptocurrencies, easy Naira integration, and features designed specifically for Nigerian users.

To protect your savings from inflation, send money globally, receive freelance payments, or shop online with crypto, HostFi offers a reliable, fast, and simple solution.

Download HostFi today and experience how managing cryptocurrency can be userfriendly and secure.